How to Understand Your Credit Score

Your credit score is easier to understand than you might think.

Here are simple ways to understand, raise, and maintain a good score.

For one thing…

Your FICO score is a number the credit bureaus give you based on five different areas.

For the most part…

A lender will look at your report scores and other areas to decide if they’ll grant you a loan.

Now that you realize…

Building and maintaining a good credit score is essential to your financial history.

It can also help you get a better-paying job and get the best rates and terms on the loans you want and need.

To begin with…

Here are five areas of consideration that make up your credit score.

You Can Raise Your Credit Score if You Know What to do And How it Works

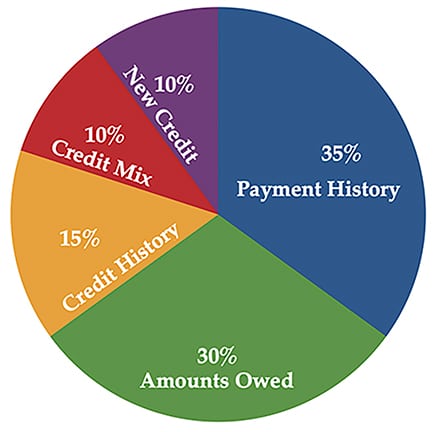

This pie chart will make up your total score.

The first piece of the pie represents 35% of your FICO score, which is your credit history.

The next slice of the pie totals 30% and represents the number of accounts and balances you have.

The ages of your debt make up the next 15% of the pie chart.

Next is the new credit balance on your credit report that makes up 10% of your credit score.

And the final 10% accounts for the types of credit you have.

In reality…

Here’s How Your Credit Score Gets Calculated

Your credit history (35%) shows the lender your payment history.

Making your payments on time can raise your FICO score.

Missing or being late on a payment can lower your credit score by 80 to 120 points.

Most importantly…

When you miss a payment, your late payment will appear on your credit report for seven years.

This is why making all your payments on time is so important.

The credit bureaus are looking for patterns of late payments. This help them to determine your credit history.

This “One Thing” is The Best Thing You Can do to Raise Your Credit Score

Without a doubt…

This is the most significant factor in helping to raise your FICO score.

Make Your Payments on Time!

The lenders look at the number of open accounts and balances on your account… this helps to determine your current financial picture.

Next, lenders look to see how much you owe. They also compare your earnings against your spending habits.

Which is also known as your debt-to-income ratio (DTI).

Lenders prefer not to see people with high debt-to-income ratios.

Because if you’re over-extended, you’re more likely to default on a loan.

You don’t want to max out your credit cards or use the most available credit.

Remember that lenders look at the percentages of available credit you use.

For instance, if you have a $2,000 credit limit and use $2,000, your usage rate is 100%.

However, if you spend $2,000 and have a credit limit of $20,000, your usage rate is only 10%.

This part of your FICO score shows if you’re over-extending yourself.

Lenders like to see 36% or less debt load for most people.

How to Get Lenders to Say Yes to Your Loan

Sometimes all you need to do is…

Show lenders that you can manage your finances well.

The length of your credit history (15%) represents the ages of your accounts… and how long you have used these accounts.

So, for example, if you have had a credit card for ten years and have maintained a positive standing with that card… this will help increase this part of your FICO score.

If you have been paying on a car loan for 3 or 4 years, the credit bureaus will apply this to a positive credit score.

The first thing to remember…

This 15% score represents the average age of your accounts; this is not based on your total history.

For instance…

They combine all your accounts and take an average from that.

The next area considered when totaling your credit score is the amount of recent debt (10%).

For example, have you recently taken on three new credit cards and a new auto loan?

Lenders prefer not to see that you opened several lines of new credit in a short period.

If so, this may drop this part of your FICO score.

The final part of your credit score represents the credit mix (10%) that your credit report shows.

The bureaus look at the number of unsecured accounts versus installment loans.

The credit bureaus are looking for a balanced mix of credit lines.

In the final analysis…

Knowing what’s included in your FICO score can help you maintain a positive credit rating.

On the positive side…

Also, this knowledge can help you rebuild or raise your FICO score.

FAQ: Our Customers Want to Know…

What is the average credit score in Colorado?

The average FICO credit score in Colorado is 728, with an average credit card balance of $5,541 per cardholder.

FICO Score Ranges

- 850–800 Exceptional

- 799–740 Very Good

- 739–670 Good

- 669–580 Fair

- 579–300 Very Poor

According to Investopedia.com

How high do credit scores go?

Credit scores range from 300 to 850.

A higher score indicates that the borrower is at a lower risk and more likely to make on-time payments.

When do credit scores update?

Credit scores usually update at least once a month.

Lenders who choose to report to the credit bureaus usually do so every month. However, not all businesses report to the credit bureaus.

How to get 850 credit score?

It’s possible to get a perfect score. However, it is constantly fluctuating based on what you’re doing with your finances.

Tips for a perfect score

-

- Pay your credit card bills often and pay them off every month.

- Consider your credit mix. Lenders like to see that you are good at managing all kinds of credit. Like credit cards, mortgages, auto loans, etc.

- Keep a solid payment history. Make a point to pay all your bills, including credit cards, when they are due or even pay them early.

- Check your credit report – look for reported errors. For the most part look for any missed payment showing up… and are they accurate?

- Beware of the “Buy now, pay later” offers that seem good at the time but they aren’t good.

- Increase your credit limit.

- Never close old accounts or credit cards. Closing accounts could lower your FICO score… because it would reduce your average age of credit lines.

- Only apply for credit when you really need it. Don’t be accepting cards because the offer seems so good you can’t pass it up.

Usually, a perfect credit score doesn’t offer any more advantages than a score like 760.

When was the credit score system invented?

The consumer credit score FICO (Fair Isaac Corporation) scoring system started in 1989.

The FICO score changed the lending business for the better. Now it’s possible to see everyone’s financial history and credit score.

Before that, there was no standard system for credit bureau data. It was more difficult to approve someone for a loan.

Why is a Credit Score so Important?

In the final analysis…

Your credit score can affect everything from your interest to your insurance rates.

Above all…

The higher your credit score, the better you get treated.

Banks, retailers, and other financial institutions give you the best deals.

Besides that…

A high credit score means you’re in good shape financially.

In other words…

That can lead to a lower interest rate on loans, and a lower rate on auto insurance.

When you have bad credit, you’ll pay more for everything, even if you don’t realize it.

You might pay more for a car loan, rent, credit card, or mortgage.

In the long run…

It makes good sense to pay attention to your credit score.

Trust me…

You’ll be glad you took the time to work on maintaining a good FICO score.

How can I Improve my Credit Score?

Building good credit to get a higher credit score is challenging.

But it’s very doable.

Unfortunately, no quick fix will raise your score by 100 points within four weeks.

For you to earn an excellent FICO score takes time and a plan.

Here are some tips that will help you boost your credit score:

-

- First, avoid having a high percentage of your available credit in use at once. If you have several credit cards, try to keep the total amount of credit you use below 30%.

- For example… If you have a credit card with a credit line for $3,000, the most you’ll want to charge is $900.

- In general… A good habit to get into for managing your finances is only to charge what you can pay off every month.

- Avoid large purchases. The more you borrow, the less you’ll be able to afford. Your best bet is to buy with cash. You can also ask for a lower price or a cheaper interest rate on a credit card.

- Don’t apply for new credit. Apply for new credit only if you need it and can afford it.

- Keep your balances low. If you have any high balances, concentrate on paying them down.

- If you have any collection accounts on your report, you’ll want to resolve them and get them removed from your credit report.

These are a few good tips to help you get on a new financial plan and a better FICO score.

If you need a car but have less than perfect credit, then contact us at 719-593-8090 and let’s see how we can help you.

We have special programs that can help you get into a vehicle today.